The easiest and fastest way to build your wealth

Earn upto 18% p.a.

- Monthly Payouts

- Predictable Performance

RBI Certified NBFC-P2P

Monthly repayments earning up to 18% p.a.

Diversification across multiple loan fractions

Strong Diversification

Secure Transactions

High Quality Loans

Join our growing tribe of investors.

linkedBest in Class Returns

Start Investing from ₹10,000 to ₹50 Lakh

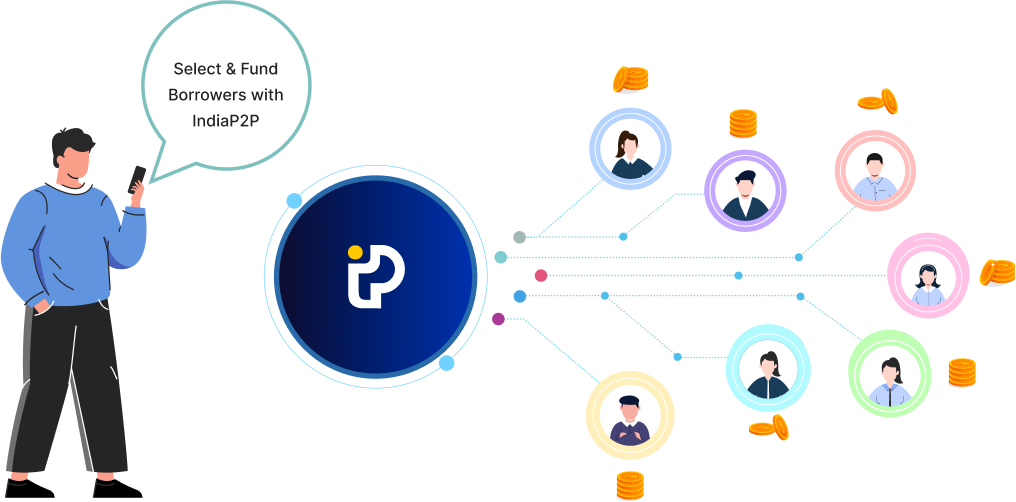

Start lending in a few simple steps

Setup Account

KYC Verification - Aadhaar, PAN, Bank account

Add Funds

All Set

E-Sign Terms and conditions

Select Borrowers

See available loans

Setup Account

KYC Verification - Aadhaar, PAN, Bank account

Add Funds

UPI or bank transfer

All Set

E-Sign Terms and conditions

Select Borrowers

See available loans

News & Announcements

What our investor's say about us

Educationist

Smooth onboarding and no post-investment effort. I'm happy that this is one investment I don't have to monitor at all.

Procurement Ops Lead

IndiaP2P is the highest returns asset in my portfolio.

Architet & Entrepreneur

This is a truly innovative product and compliments my other investments. The returns are indeed exciting and the lack of volatility comforting.

VP Marketing

I love that my IndiaP2P investment has such a positive impact in promoting growth of so many businesses. Even better that these are run by women.

CA

I invested with IndiaP2P because of the high returns and only later discovered what a wonderfully meaningful investment it is. I would call it a nation-building investment.

Consultant

Superior returns with a transparent view of where investments are deployed. Glad to see that returns are not linked to speculation

Entrepreneur

Women x Business = Great Returns. I like that with IndiaP2P I am able to do this. I look forward to interacting in person with some of the businesswomen IndiaP2P faciliates lending to. Their grit and stories are inspiring.

Entreprenuer-Climate Finance

I was impressed with the founding team's story, experience and how they worked on creating an investment product that gives high returns and does good for women entrepreneurs. I believe that having more women in business is our best chance at becoming a prosperous nation.

Agritech Entreprenuer

You are offering unbelievable returns. I look forward to the 1st of every month when they hit my bank account.

IT Professional

An investment product that I finally understand. Simple and super-easy to understand.

Corporate Leader

An investment that supports the business aspirations of borrowers while fulfilling my financial goals.

Retired Army

Great way to create a second, monthly income

Data Lead

I like the transparency in stating returns in APR or per annum basis. No misleading IRRs or fancy return calculations.

Product Manager

I am a conservative investor and IndiaP2P worked for me because of being RBI regulated and easy to understand.

Musician

Seeing returns hit my bank account every month makes me smile. Please launch your mobile app soon.

Professional

My investment corpus automatically increases every month with the growth plan and enables more borrowers.

Consultant

A purposeful investment that doubles up as a passive income stream.

Latest Blogs

Recognition

2023 Winner,

WWB's Fintech Innovation Challenge

Notable mention -

Ethical Investing in India by Siva Prasad Bose

Notable mention -

GIZ Women Entrepreneur Financing Toolkit

Notable mention -

Fintech Feminists by Nicole Casperson

Frequently asked questions

Who do I transfer funds to for lending?

When do I start earning interest on the loans I fund?

You start earning interest from the date of disbursement of the loans you choose subject to repayments received from borrowers.

Why is there a predefined minimum allocation per loan/borrower?

Different borrowers are seeking to borrow different amounts. The minimum allocation amount allows us to fulfil these loans in a timely manner while allowing multiple lenders to take small exposures to a borrower.

Will I be able to track borrower wise repayments?

Yes, before and upon investing detailed loan reports will be available on your IndiaP2P dashboard detailing monthly repayment performance of your borrowers.

What happens if a borrower delays repayments or defaults?

In case of delayed repayments, their receipt into your bank account will also be delayed. In case of defaults, there will be loss of that amount of investment. We recommend that lenders spread their capital across multiple borrowers to minimize this risk.

As a platform we will put in best efforts to recover delays and defaults.

Can I make a withdrawal before the lock-in period is over?

No. Per RBI regulations, no bulk withdrawals are permitted, only received repayments can be withdrawn.

Terms and Conditons for investor referrals

Both you and your referred friend would earn 1% of their first investment as a top-up to your first investment plans. You can refer to as many friends as you like. Total referral earnings are capped at INR 5000. Referral earnings will be visible separately in your dashboard under the Rewards section. If you'd like to earn more than INR 5000 via referrals then please contact us to join our Ambassador program. IndiaP2P reserves all rights to amend this scheme at any time without prior notice.

Are there any restrictions on how much I can invest on IndiaP2P?

Yes, across all peer to peer lending platforms regulated by the RBI you can invest a maximum of ₹50 lakhs. For investments above 10 lakhs a certificate from a CA is required to ascertain your net worth. Our investor services team will assist you with this certificate. Additionally, the maximum lending per borrower is restricted to ₹25,000 for risk mitigation purposes.

What happens to existing lenders in Growth and Monthly Income Plan post RBI regulations dated August 16,2024?

As per RBI regulations dated August 16, 2024 existing investors in the IndiaP2P Growth Plan and IndiaP2P Monthly Income Plan will receive EMIs (principal + interest) against loans funded into their bank accounts every month. These repayments can be re-invested anytime into the IndiaP2P Monthly Income Plan - Plus.

What do I need to do to invest on IndiaP2P?

You need to complete a quick online KYC for which you will need to keep your Aadhaar, PAN, and bank details handy. Post KYC verification we will create your unique virtual escrow account into which you can deposit funds for investing in IndiaP2P products. If you are using NEFT, IMPS, or RTGS to transfer funds into your escrow account you will need to add this account as a beneficiary to your net banking first. This entire process only takes a few minutes. No physical paper submission is required. Please note that we do not accept any form of cash investments, fees, or payments. You must be above 18 years of age.

Is IndiaP2P recognised by the RBI and is it regulated?

IndiaP2P is a NBFC-P2P, licensed by the Reserve Bank of India (RBI) under the name Trickle Flood Technologies Pvt. Ltd.Yes, IndiaP2P is an NBFC-P2P certified by the Reserve Bank of India (RBI). IndiaP2P’s operations and offerings to lenders and borrowers are bound by RBI regulations.

What is P2P Lending?

P2P stands for Peer to Peer lending. It enables individuals to obtain loans directly from other individuals without the involvement of any intermediary. It’s an alternate option for borrowing money other than Banks. P2P lending is regulated by the Reserve Bank of India.

Do I need to pay tax on my earnings?

Yes, all earnings are subject to taxation. Your interest earnings on IndiaP2P will be considered as ‘other income’ in your annual returns and taxed as per your prevailing income bracket. We will share an earnings statement with you for every fiscal year. You can also view your earnings in real time on your IndiaP2P account dashboard.

What is the overall investment tenure?

The overall investment tenure is 24 months, with some returns coming earlier from shorter loans.

Is there a minimum amount I need to invest?

Yes, you can invest as low as ₹25,000 as your initial investment. Tops up/re-investment can be made in any amount. Maximum investment across all P2P lending platforms is capped at ₹50 lakhs.

What information does IndiaP2P collect about me?

We require your KYC and tax identification information as per law. Details of additional information collected can be seen in our Privacy Policy. Please note that we do not share your information with any third parties for sale purposes.

How are borrowers screened and assessed by IndiaP2P?

IndiaP2P screens and rates borrowers using our credit-algorithm as defined here (IndiaP2P Credit Policy) to ensure their creditworthiness and assess risk potential. In addition, most borrowers are verified physically by our team. As an investor lender, you can see and filter borrowers basis various criteria. Typical loan ticket sizes sought by borrowers range from ₹30,000 to ₹100,000. Eligible borrowers are rated between A and F basis stated credit policy.

How can I reach you to learn more?

You can email us at investors@indiap2p.com or schedule a quick call with our investor support team at your convenience here

What does asset allocation mean?

How is consumer inflation estimated and how does it affect me? What is my personal inflation rate?

Understanding Market Bubbles

What is the endowment bias and how does it affect our decision-making around finances and investing?

What is speculation or speculating and how is it different from investing?

What is Mental Accounting and how does it affect me?

What is meant by the Time Value of Money?

Loss Aversion

What is the Illusion of Control and does it explain your investment choices?

What is meant by real returns? Are your investments actually earning as much as you think?

What are productive assets? And why does Warren Buffet love them?

What should I do when inflation is rising?

What is the Icarus Paradox? And how does it explain the failure of once super-successful companies?

What is the Rule of 72?

The rule of 72 is a thumb rule to quickly estimate how many years it will take for your money to double for a given rate of return. For example: If your Fixed Deposits are paying a return of 4.5%. It will take 72/4.5 = 16 years for your money to double. With IndiaP2P, you can earn up to 16%. Thereby doubling you money in 72/16 = 4.5 years.

What is meant by Net-worth?

What are Mutual Funds and how can I asses their performance?

What is Microfinance?

What is FOMO investing?

What is Angel Investing? Should I become an Angel investor and invest in startups?

What is asset allocation?

What is Volatility and how does it affect investment returns?

What is meant by ‘compounding’?

What is diversification?

What is the difference between regulated and unregulated investment products?

What is passive income?

What are the risks associated with fixed-income investments and especially with IndiaP2P?

What are fixed-income investment products?

What types of loans and borrowers does IndiaP2P source from?

What do fractionalized loans mean?

What is peer-to-peer (P2P) lending and how is it different from traditional lending?

How can I contact you to learn more?

Will my contact details be displayed on the IndiaP2P website or lender mobile app?

What happens if I cannot repay?

Can I change my NACH debit/EMI repayment account after disbursement?

Will multiple lenders fund my loan? Will I have to repay all of them separately?

Can I prepay my loan on IndiaP2P?

How much time does IndiaP2P take to evaluate my loan application?

Am I required to present collateral for my loan?

How is interest calculated?

What is the eligibility criteria for borrowing on IndiaP2P?

What are the benefits of borrowing on IndiaP2P?

What type of loans are available on IndiaP2P?